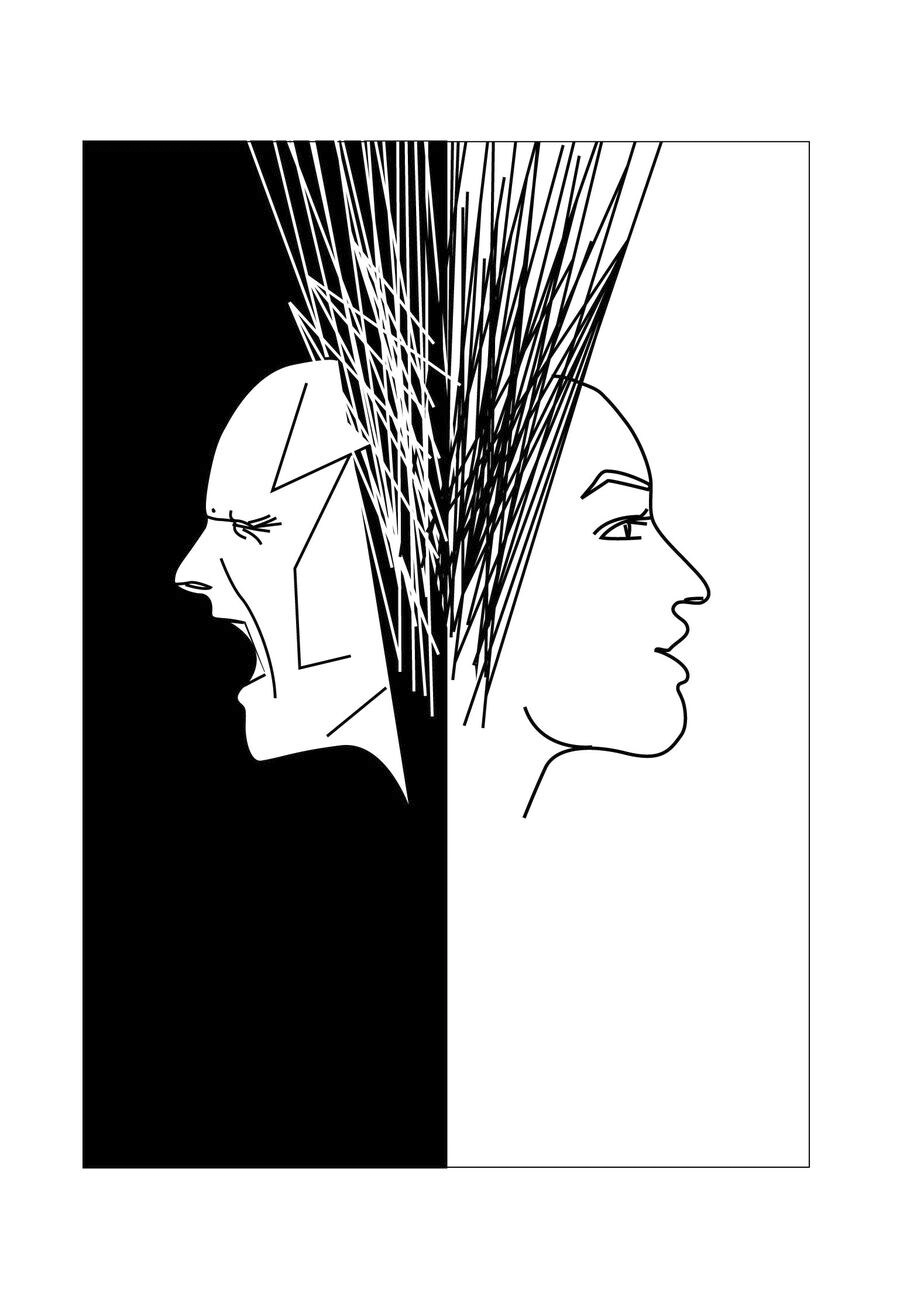

Human nature is to be right all the time. Nobody likes to be wrong even in petty/useless arguments. This particular thought process is one of the primary reasons for many opting for methods that shows high winning percentage with abysmal Risk:Reward ratio. Many of the world’s renowned traders are trend followers and trend following usually delivers something that human brain is not used to – More losers than winners with superior Risk:Reward ratio. » More »