Introduction

In the years 2007 & 2008, I was a premium video subscriber of John Carter’s (Author of ‘Mastering the trade’ book) website. I had seen him taking a $10,000 account to $100,000 in 1 year and that was the first time I ever saw someone do compounding in a trading account live. It had a major impact on me as it acted as a great inspiration for me to think beyond what I thought was possible. Many of us think that compounding word does not apply to trading and it is an ‘investing’ term. Far from the truth, ? Any financial account should be exposed to compounding !!

I always thought I should do the same in the Indian markets but my circle in trading was less than 25 traders (from 2006 to 2013 – many traveled with me in trading and many quit. It was almost like a revolving door. Folks come into this profession and go out) Trust me, the desire to show compounding was burning inside me from December 2013 itself (this was the month Nithin of Zerodha interviewed me as part of the Interview series he was doing) but there weren’t many people I knew by then and it would not have reached many folks.

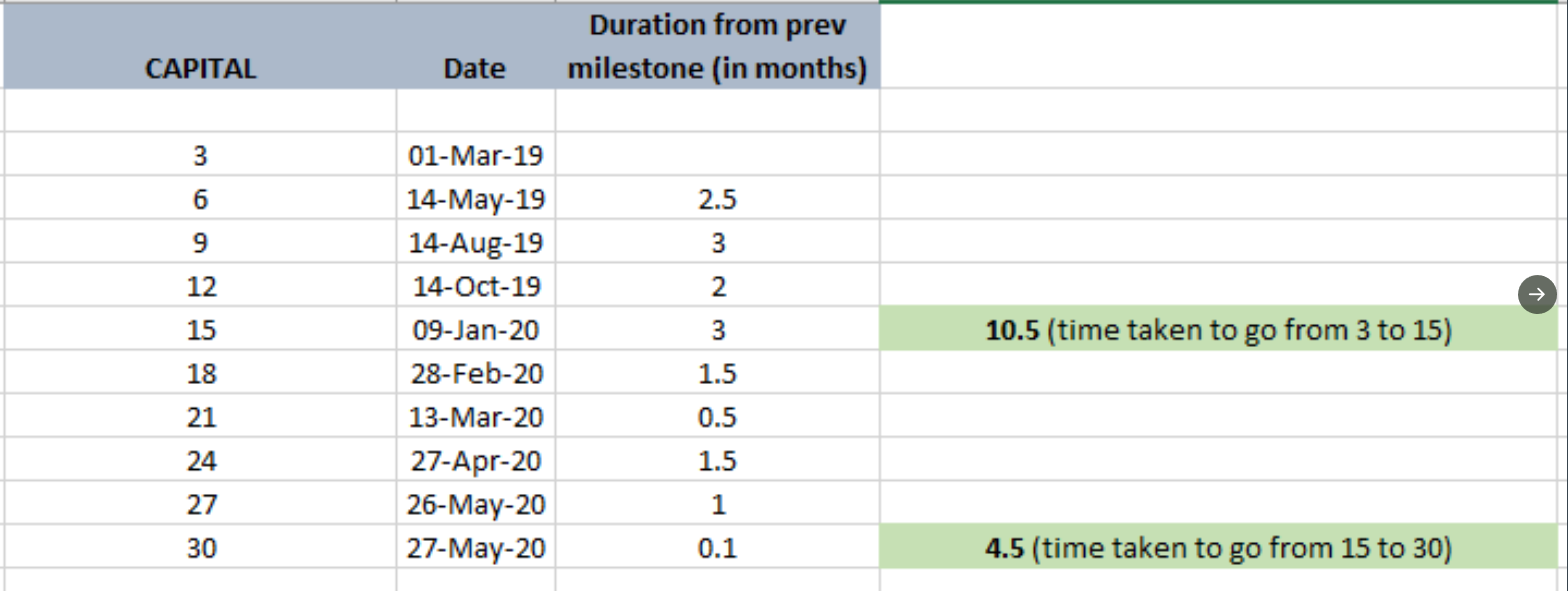

Fast forward to February 2019 – I had around 13 years of trading experience (some 11 years of trading for a living by then under my belt – this point is very important and it will pop up again in the fag end of the blogpost) and some 4000+ followers in twitter. I thought this was the right moment to experiment on how to take a small account to a decent-sized account by compounding.

There was so much of negativity on intraday trading for a long time in the trading fraternity and on options buying as well (thanks to new expiry day option sellers in the Indian market).

Three reasons to choose options buying initially –

a) I had made around 45% of futures points in options ATM buying for the FY 2018-19 in my positional trading account and I knew it would be much better in intraday (due to reduced theta decay).

b) Money management can be more aggressive

c) Liquidity in options is better than futures.

Finally, I decided to hit 2 birds with one stone and the choice for this experiment was “Intraday trading + options buying” combination.

Before the Start of the experiment

Please click the link below to read further on the thought process before the start of the experiment.

Episodes

I had created three separate sub-posts for buying, selling and synthetic futures episodes.

Please click on the links to read further —

Observations and relevant pointers

1. I never thought about any of these numbers (even in my wildest dreams) when I started

2. I deliberately did not talk about Options buying points vs futures points and options selling points vs futures points in those respective time periods as we saw unprecedented VIX movements and that might skew our judgement.

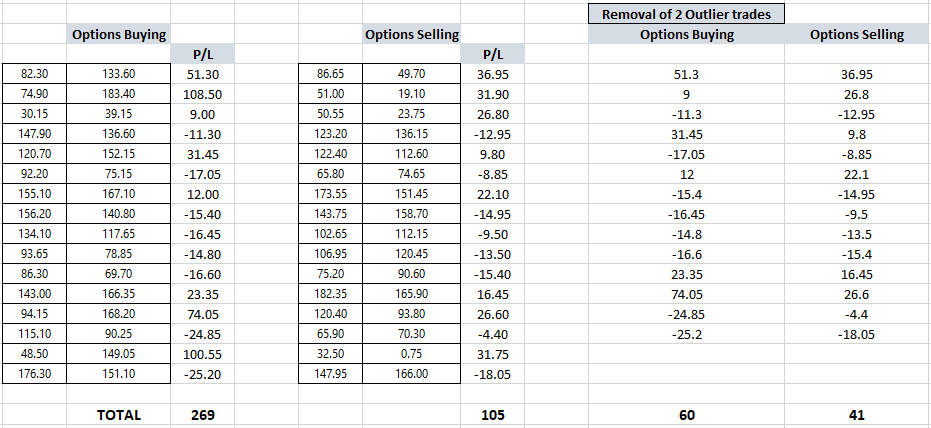

Nevertheless, Options buying seems a bit advantageous compared to options selling intraday but as i mentioned elsewhere, it heavily depends on the average number of hours in the trade

3. Trading Synthetic Futures for the last month and this is my observation. If you are trading NF and trailing SL’s, there is a possibility of catching 1-3 big trades in a month(more than 100/150 points NF trade).

In that case, options buying looks favorable on those days and overall, beats options selling by a huge margin. But, this also means that you need to be available or your algo should be up and running (without broker errors) every single day.

If we remove the two outlier trades, then buying and selling is pretty much similar. Selling gives a relatively even distribution of trades and buying beats selling in those 1-2 trades substantially.

a) We should also remember what happened to VIX in the last 1 month – stayed in the range of 30 to 35

b)When VIX is rising, it is a buyers paradise. When VIX is cooling off, it is a sellers paradise. When VIX is really low, sellers have a slight advantage over buyers.

Kindly remember that I am a complete novice in options and almost everyone I know is more knowledgeable than me in options. These are just my observations on buying and selling (as this seems to be the popular question/concern among new breed of traders) based on the live trades taken every day for the past 15 months.

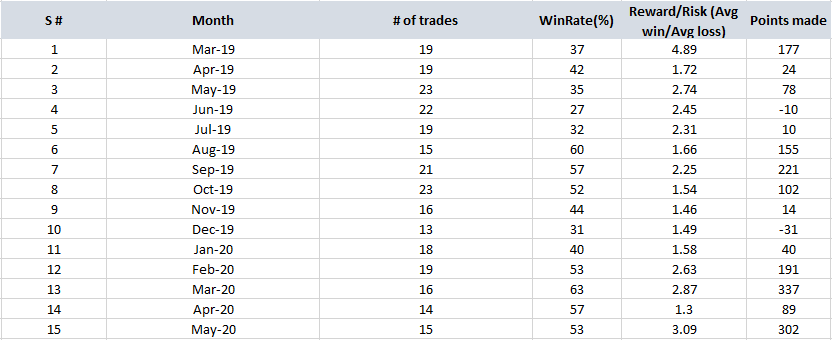

4. Handling losses and drawdowns is the name of the game – be it positional, intraday or investing

5. Winrate should be seen along with Risk:Reward. If you have noticed, my winrate was a bit low when I was doing options buying and was higher during options selling (for obvious reasons). But if we look at them in tandem with Risk:Reward, more things come into play. WR+RR should be seen together – not alone.

6. There are a lot of misconceptions around drawdowns and return on investment (ROI). Please read this tweet as it also explains about small account vs large account returns

GM everyone 😊

Received some queries over email on drawdown and return on investment (ROI)

So, am gonna try to hit two birds with one stone in this thread 😊

1. Drawdowns and confusions around it

2. Small acct returns vs large acct returns(1/n) pic.twitter.com/8JjQJkDitJ

— Madan (@madan_kumar) December 3, 2019

7. If you take a random trade and it becomes a profit, your trading future is doomed for the next several months. This creates a false illusion that it is OK to break rules and take random trades. This path is filled with corpses of many trading accounts.

“Good trade” is a trade where you followed your plan (even if there’s a 300 pts gap against you) and “bad trade” is a trade where you did not follow your plan (even if you made 500 points profit on that trade). It takes time to sink this point in but once it sinks in, it is easy to understand mechanical trading. Until that point of time, mechanical trading will feel like a bad dream

8. Sticking to a simple plan is more important than ‘predicting’ market moves. Lets delegate the market move prediction to analysts and paper/single digit lot traders.

9. For successful execution of a mechanical system (only mechanical systems can be backtested), one has to ‘act dumb’ in front of the markets. Very tough for an erudite human being. It is tougher for folks who are highly educated or well-accomplished in their life already.

10. Underestimating the probability of losing streak over large sample – one should learn to have unshakeable belief in ‘law of large numbers’

11. Try increasing the execution efficiency above 90-95%. Results would be dramatic. A simple comparison of how many points you would have made had you taken all the trades without any errors (vs) your current points will be a big eye-opener

12. Never taken a single day off (except for one day where my son fell ill) as I ran this like how a business owner/shopkeeper runs his business. This experiment was very close to my heart and it took the same kind of determination/grit as what it took to build my positional account.

13. Just because someone traded a 3L account and built it to 30L, it does not mean everybody else can do it. Remember, losing this 3L or 30L is not going to affect my lifestyle even by an inch. So, focus on getting better at the trading processes and money will follow.

14. I am sure there are methodologies that are much better than what I trade with. But, if we think hard, it might take 1-2 years more for system B compared to system A (assuming Sys A has better expectancy than Sys B and both have the same number of trades in a year) to reach the same goal. Think about this point – very important one. No point jumping systems.

15. 33L to 1cr is 200% and lets see how long this is gonna take 🙂

16. Long story short – Create a mechanical system -> backtest it for a longer time -> devise MM -> bring capital -> work on things that are making your execution difficult (has to be easy) -> take all the trades -> gain psychological resilience (it happens simultaneously).

Gratitude

I would like to take this opportunity to thank the following folks wholeheartedly —

1. Krish from Bangalore (my workshop participant + mentee and a great friend now) helped in creating this excel around Feb 2019. He designed everything from scratch and cannot thank him enough for this gesture

2. Bharat (workshop participant) automated all the calculations and included few more sheets for visual representation. – totally amazed by his magnanimity in offering his time/effort

3. Santosh (workshop participant) helped in calculating drawdown and that column got included in the sheet

4. Numerous others who gave countless suggestions, feedback (both constructive and destructive), and inputs via email/Whatsapp/Telegram/tweets in this journey.

Thanks so much for reading this long post but i sincerely hope this is useful to someone out there.

Happy trading, all !