Interview titled Mr Consistent returning incredible returns with Nithin Kamath, Zerodha published on December 21, 2013

Interview titled Mr Consistent returning incredible returns with Nithin Kamath, Zerodha published on December 21, 2013

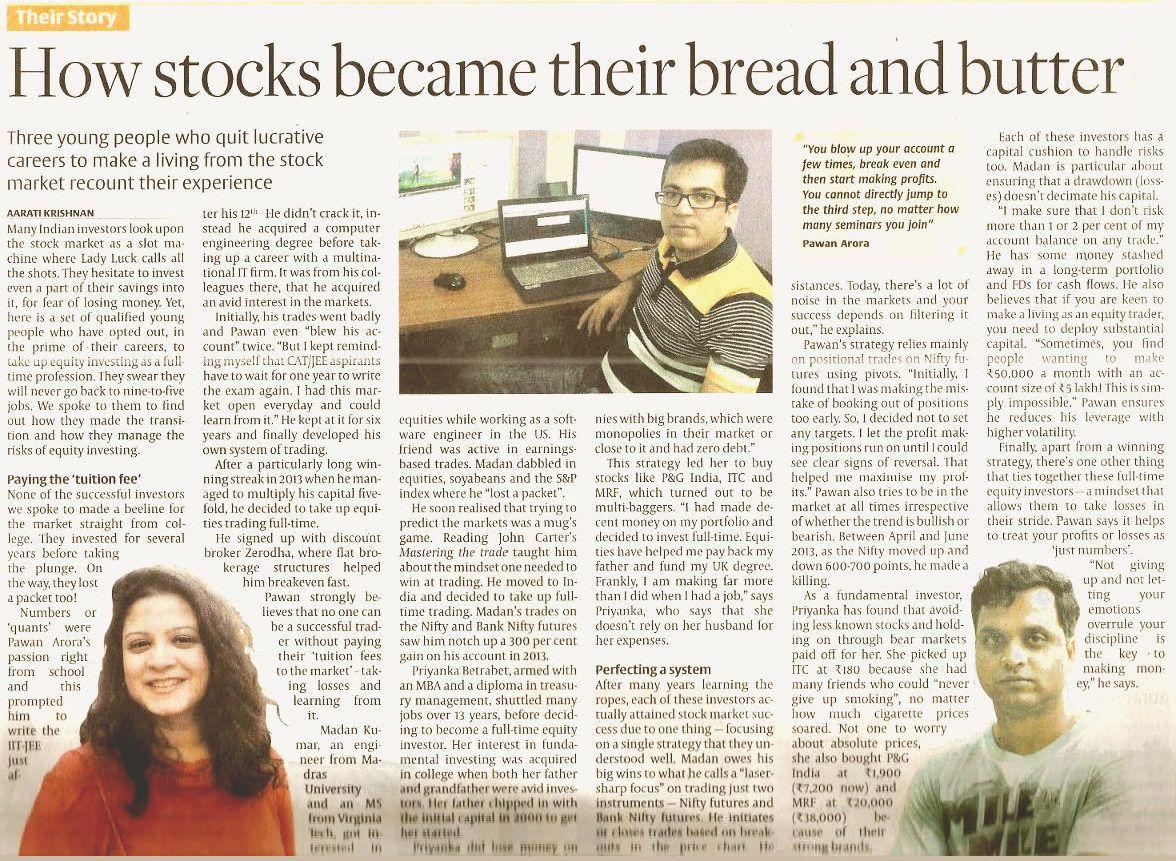

Featured in Hindu Businessline article. How stocks became their bread and butter back in 2015

I have been hearing some stories of traders/investors who have lost quite a sum of money in the last few days. Worrisome part is that some folks have borrowed money for trading and have lost it as well. Few other folks who are managing other’s money (PMS) have also lost substantial amount too. » More »