Besides loving to trade and playing cricket, I am an ardent subscriber to the statistical concept – the law of large numbers. According to probability theory, the law of large numbers is a theorem that describes the result of performing the same experiment a large number of times. Moreover, the average of the results obtained from a large number of trials should be close to the expected value, and will tend to become closer as more trials are performed.

Let us look at some illustrations first before talking about its implications in trading.

Law of Large numbers and Coin toss

Law of large numbers is best illustrated by the example of a coin flip, which has a 50% chance of landing on heads. If we flip the coin twice, we have almost exactly equal chances of any scenario happening: heads twice, tails twice, or evenly split. The probability of getting 5 heads and 5 tails on ten flips is just 8% but that probability keeps increasing as we increase the sample size. If one flips the coin 100 times, the probability of getting 50 heads and 50 tails (P=0.5) increases to 70% and so on.

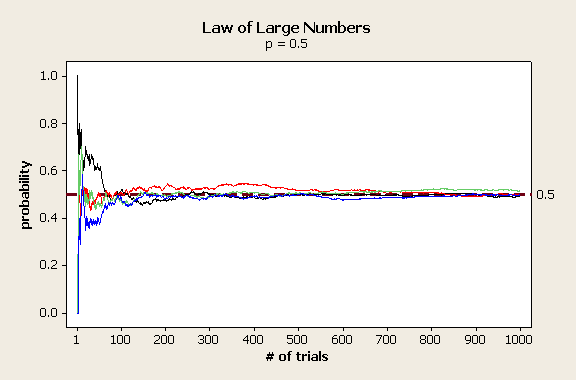

Below is a depiction of the Law of Large Numbers in action, for 1000 trials –

As one can see, the more the sample size (trials) is, the probability of getting equal number of heads/tails increases.

Law of large numbers and casinos

Coin flips are interesting theoretically, but the Law of Large numbers has a number of practical implications in the real world as well.

A famous example is Casinos – who can forget the ringing sound of slot machines/clamoring laughters sound in the craps table of Casino halls. Casinos live and die by the law of large numbers. Each game has a house edge built into it, representing the average loss over the initial bet. Some sample edges are –

* Blackjack – 0.75%

* Baccarat – 1.2%

* Craps – 1.4%

* Roulette – 5%

* Slot machines – 5-10%

Over longer time frames, it becomes increasingly likely that the house edge will represent the casino’s profit margin.

Law of large numbers and trading

When it comes to trading, many misinterpret(in a negative way) this law of large numbers. They think that the more they trade, they would have more losses which leads to account blow-up. If a traders’ methodology has a statistical ‘edge’, and if he does not change the underlying parameters on the way, it is better for a trader to let the law of large numbers to work in his/her favor.

Trading decisions may appear to be binary – either buy or sell or up or down, but they are not. There are a critical variables which must be accounted for, such as how much am willing to lose/how to trail the profits, or in other words, what is the risk/reward of the trade and how do I manage the trade. So, there is something other than chance that comes into play when trading, and that is skill and technique.

It stands to reason then, that the better your skills and technique, the more you should trade. While Law of large numbers is important because it “guarantees” stable long-term results for random events, it follows that it is also important that our sample of trades is large enough to maximize the number of successful outcomes from our skillful trades and therefore maximize your earning potential. So, if it sounds so simple, why does traders do not allow this law to work for themselves? Why do they jump ships on the way(changing trading systems)?

Think about this for a second. The trader starts trading their plan with all good intentions. Things may or may not go well straight away, but sooner or later as the markets behavior ebbs and flows with/against the strategy’s strengths and weaknesses, losing trades will inevitably occur. At this point of time, the trader gets scared. They don’t like to give money back to the market, so they decide to try and modify the system to filter out trades like that last losing one. They begin to add indicators to charts, coming up with new ever more convoluted combinations, furiously testing to see what cuts out the most bad signals while leaving in place the good ones. A few times round this loop and suddenly, their chart starts to resemble something a seismologist might be more used to seeing than a price chart 🙂 As a result, again, the loop starts – they never let ‘law of large numbers’ to work as they dont stick around with one idea. Law of large numbers will be rendered meaningless if we keep changing the rules on the way.

Law of large numbers and behavioral difficulties

To let the law of large numbers work for us, we need to put trade after trade, over and over again without changing the underlying parameters. Just like onerously bolting on wheels on an automobile assembly line, making a series of trades can be very tedious. It may be hard to maintain self-control at times. It is understandable. We are human, and humans have a strong primal urge to seek out drama and action.

The kind of person who is attracted to trading is not the person who prefers tedium to excitement. This is the raw fact. If we are a trader, we’re probably the kind of person who has shunned a mundane 9-to-5 job for a more unconventional, adventurous profession (many come to trading for this reason). The excitement of working as a full time, active trader appeals to us. We thrive on the uncertainty and endless possibilities. What attracts us to trading, however, may also be a reason for our downfall, unless we are careful. We may be the kind of person who gets bored easily. It is quite possible that the long hours of self-control required to make a profit may be difficult to maintain. This is why many crave for action in the markets. So, eventually, they put on trades that is not part of their plan. It is exactly at this juncture, we break the ‘law of large numbers’ as it assumes that we do the same kind of trades(based on a definite idea) day in/day out. Essentially, we never stick around (or stick around with the same idea) for law of large numbers to work.

How to gain from Law of large numbers

It would be prudent if a trader(new and experienced alike) does the following –

1. Create a trading plan

2. Backtest the plan with large sample size (never fall victim to small sample skewing)

3. Determine your risk based on backtesting parameters

4. Create a money management plan

5. Stick to the plan to let the law of large numbers work

Final thoughts

It is illogical to subscribe to the theory that ” you’re only as good as your last trade. ” If you are going to trade for a living, there is no last trade, only the next trade. Whether, our last trade was a winner or a loser, it has absolutely no bearing on the outcome of our next trade.

Unlike gambling, a winning streak by a trader will NOT eventually be overcome by the parameters of the game, unless he somehow convinces himself that this is his inevitable outcome. Trading is not gambling where the house has the edge (let us not focus on the broker’s commission and negative sum game for a moment). Trading is a performance based activity that requires skill, technique, experience and above all, practice. Most important though, the trader must have the right attitude, focus, patience, and self-confidence, and then the trader will be the one who possesses the edge – not the other way around 🙂

Happy trading !!