There’s a saying that’s been used in pool halls and poker rooms – if you gonna sweat it, then don’t bet it. Don’t get me wrong here. it’s good to be a little nervous because it keeps things exciting and in perspective but if we see our setups working again and again in a consistent manner and we don’t put on a trade – that’s like having the “the upper hand” in anything that involves winning and we are not betting. It’s like having the best batsmen in our team and no wicket-keeper behind us, it’s like spotting Tiger Woods a 10 stoke lead, and it’s like getting a Royal Flush (in poker) when the pot is maxed out.

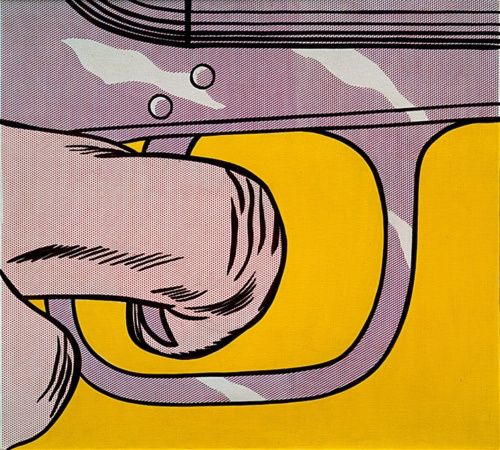

Bottomline – we just got to do it. But, as we know already, it is easier said than done unless we know and address the root causes. This is commonly called as ‘fear of pulling the trigger’ in trading arena.

Before doling out solutions, we need to understand the psychological aspects behind this fear.

Reasons behind this psychological fear

1. Fear of loss

We can break this fear down into two distinct psychological characteristics:

A. Lack of confidence – encompasses all things associated with a trade (the whole nine yards) Starting from analysis, methodology for trade selection (mechanics) execution and a plan to handle exogenous events.

B. Lack of discipline – includes all of the above but with direct focus on self, and our ability to react, either in accordance with a specific set of “rules”, or to unexpected, unanticipated scenarios.

2. Fear of winning

This fear may sound funny but this is very much true as any other fear involved in trading. This fear can be broken down into a plethora of psychological characteristics, all of which can be clumped into a single fear – fear of change.

Fear of change involves all aspects of our life at this moment –

a. Winning will make us more desirable financially and-or personally (aspect of relationships),

b. We believe we are not entitled to win (aspect of self-image),

c. A successful career means more responsibility (aspect of personal growth).

The possibilities of why we would fear change are nearly endless. However, the reasons are completely unique to us. There is no trading specific material for this. Self-help books and reading material might help a bit.

3. Urge to make money faster

This urge can make us not want to lose in any trade. As losing equates to lesser capital than where we started. This urge can also stem from the fact that our livelihood depends on the money we make from trading

4. Mechanical vs Discretionary system

If we are a discretionary trader, we’re probably suffering from a condition that golfers suffer from time to time: the yipps. The yipps is a putting condition where one get so anxious over where the ball is going to go that we get janked up before we hit it. It’s typically a fear of blowing it past the hole. In other words, fretting about the result even before we hit the ball. Usually a golf instructor would say – swing smoothly and keep your head down. A discretionary trader goes through ‘yipps’ more than a mechanical trader. Mechanical traders face some other demon – second-guessing the system. If our system is mechanical, yipps will not exist that much.

Possible solutions to these conditions

1. Back testing

Backtesting would obviously give us confidence to pull the trigger but what would help us when we face a losing streak? That’s where reduced leverage (to start with) would help us. Start out with 1 lot, follow the system to the dot. It is really important because it creates that ‘discipline’ brain muscle in us. And, slowly and gradually move up in size. Remember, we are all in this profession for the long haul – no hurry. But, if a trader is in pressure to make money right away (and big), market will show us the road to adversity.

2. Trading for monthly expenses

Most of the newbie traders have the strong urge to make money (who doesn’t) but this can act very counter-productive to our efforts. Do not trade for monthly expenses – we can start withdrawing money for our expenses in the later stage but not when we have issues in pulling the trigger. So, having backup money (to cover expenses for 3-4 years) while trading initially is imperative.

3. Little tuning to our mindset

This will also go a long way in our favor. Whenever we have a setup, the first thing we can start telling to ourselves is that “this is going to be a losing trade and I am going to get stopped out on this” . We EXPECT to lose on this trade but we don’t HOPE to. There is a difference between expecting and hoping. We HOPE to win on this trade but we don’t expect to. When we lose, we are ok as we expect and prepare for it. When we do win, we give a pat on our shoulder since we expected to lose. Tomorrow we will start all over again – again expect to lose but hope to win.

Good luck and happy trading !!