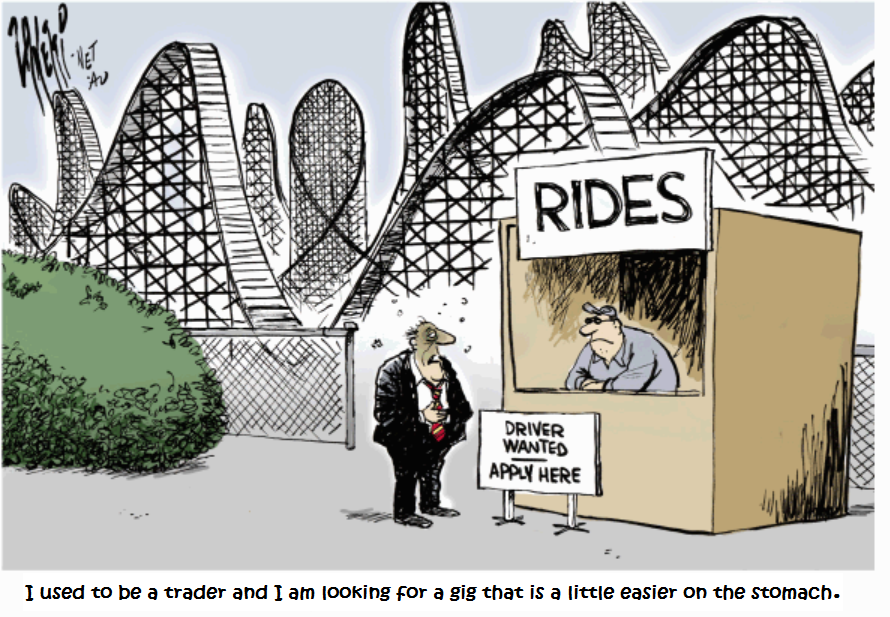

How many times have we heard this word ‘psychology’ getting associated with trading profession? Innumerable times. To the uninitiated, it seems to be an over-rated (probably abused) word. I will make an attempt to give a different perspective about psychology’s part in trading as there are lot of literature that talks about cliched topics like ‘handling fear/greed and discipline issues’. We will not focus on those items in this blogpost.

To all the readers reading this post, have you ever faced any of the following issues?

1. Not taking a trade in your plan because you did not think it would work (after a couple of losses in a row)?

2. Taking a trade immediately after a loss that is not in your plan? And then after another loss, another trade not in your plan?

3. Chasing a price move because you are afraid it is going to run without you only to see it reverse after you jump in?

4. Averaging into a losing position because you just believe you are right and price will come back to where you bought?

5. Moving your stop further away from your original stop to give the trade more room or moving to breakeven too early?

6. Continuous counter trend trades because you feel price has moved too far and you expect a reversal?

7. Refusal to close out a losing trade and holding it until later in the day or the next day taking a bigger loss than your original stop?

If you haven’t had any of these issues, please stop reading this blogpost further – you are either a master/legendary trader or have never traded before!! Chances are if we have had several of these happen to us, we either have no trading plan or should not be trading or our mindset around trading needs some work. We can call it psychology, call it mindset, call it mental discipline, or whatever suits our fancy.

The difference between unsuccessful traders, net profitable traders, and big money making traders is smaller than we think. It usually boils down to a small but perceptible edge, and while it can be related to poor money management, inadequate funds, or a bad methodology, it is usually an internal factor – a lack of discipline, emotional control, patience, and especially an improper attitude about losing and risk. Mind you, all these factors collectively called as ‘trading psychology’. So, it does not matter what we call it, but the intrinsic difficulties are real and they reflect in our trading P&L.

But to understand this phenomenon more deeply, we need to understand how mind works and how it relates to trading profession. Let’s start by dividing the mind into three divisions – inner subconscious mind, the subconscious mind and the conscious mind. We’re not going to talk about the inner subconscious mind (its primary function is to run our organs automatically) and the conscious mind (as our emotions are not relevant to them). Our focus will be on the ‘sub-conscious mind’. On a daily basis, we spend about 1-5% in the conscious mind. The rest is spent in the subconscious mind. The conscious mind perceives about 40 bits of information per second and on the contrary, the subconscious mind about 20 million bits of information/second. As they say -“Your brain (subconscious mind) sees even when you don’t”. And it’s never dormant. In fact, it has been awake and recording since the time we were a fetus.

Subconscious mind and the way it works

Subconscious mind can be divided into 3 subsections –

1. The Memory Mind – It has recorded all our memories, all events, and actions, everything that ever happened in our life since the time we were a fetus. Think of it as a video camera with five senses. All of our memories (from brain’s inception) are there and they are present constantly in every moment of your life.

2. The Emotional Mind – It’s the part that contains all of our emotions. Whenever we act, react on an emotional basis, the subconscious mind is involved. Have you ever thought of that situation when we reacted so silly, and we asked ourselves later, why in the whole world did we react like that, or why did we say that? It’s because of the emotive information that’s stored in our subconscious mind. Remember, that conscious mind has no role here – analytical part of the brain (part of conscious mind) cannot even start processing the information yet.

3. The Protective Mind – It has the role of protecting us against what it perceives as dangerous.

How subconscious mind is built

The basis for sub-conscious mind is created from day zero of our life till the age of about 7. That’s because, our brain waves, in that period are in a kind of hypnotic state. They move very slowly, and our whole subconscious is very much completely open. During these years, we lack the critical factor –the analytical and rational mind. And that means that every little thing that’s put there (not that it stays there) creates the fundamentals of our character, and our outcomes in life.

Subconscious mind and need for security

We understood how the mind is built but who’s putting in the information? Well, most of it comes from our parents or the people who raise us up. They are the ones in charge of our lives. One of our primate need is the ‘need for security‘. As I have a 8 months old baby now, I can give an example w.r.t to a baby. Normally, when a baby starts crying, it is taken up by the mother, it continues to cry. The mother checks the diaper, changes it. The baby keeps on crying. The last step – the one that always works – is to bring the baby to the bosom and feed it with breast milk (or stick a bottle with milk in its mouth if one is not breastfeeding). That’s when the baby finally stops crying.

What’s actually happening? The need for security is fulfilled. Being brought up to the bosom, the baby feels the warmth/care from the mother and the need for security is fulfilled. The only problem, is that it creates an association. The brain creates that association to food. In other words, when I get food, then I’m secure. We grow up, and every time, we had a stressed day or we feel depressed, we find ourselves putting something in your mouth. If we start to abuse food, we give birth to obesity. But, remember it has to do with the need of fulfilling ones security. Other quick examples are classical as well. Just think of how many parents out there telling their children, things like “you’re not worthy”, “you can’t do that”, “you’re bad”, “you’ll never be able to” and so on and so forth. So, it is prudent for a parent to watch what they are really telling their kids as that information is shaping up our kid’s future (more so, when they are in their young/blossoming years).

The real us, is our subconscious mind, because we’re spending there about 95% of our daily lives. The subconscious mind is this device ‘playing on’ the program we got and it is put there by our parents and by society.

Subconscious mind and trading

Ok great!! But, what does all this has to do with trading then? Have you guys ever heard of, fear of success? We do want to make money, we love money, we love trading but we’re still losing money. What we’re experiencing here is a conflict between the conscious mind and the subconscious mind. Remember, who the real you is! We’re actually the sum of all our programming. Funny thing right? So, being the sum of all our programs and given the fact that subconscious mind has the role of protecting us – Bingo, we got a great recipe!! It doesn’t allow us to make money. Because somewhere in the program, we’ve got a bad experience that has a negative charge and it keeps holding us back from getting hurt again.

See this innocuous looking statement – “In order to earn money, you have to work hard”. It has probably been put there, somewhere between the age of 0-7. Unfortunately, our parents became parents without getting any instruction manual on how to raise kids and we have the social construction as well in the picture. Nothing against the parents here but just wanted to put the facts across. Our parents inadvertently created ‘reward and punishment’ mechanism. They punish us when we’re not following their instruction and reward us when we do as we’re told. The kind of reward we get is, acceptance. When we get that acceptance, we then fulfill one of our basic needs – the need for security.

This creates a dogged association here –”In order to earn money, we have to work hard” which in turn equalizes to ‘safety’. We grow up, and start to work, and eventually we find out that, working hard equals earning money. And the safety need is fulfilled. Now, fast forward few years and you enter the arena of trading. We get into situations that can make us money easily, without having to work hard. BANG – That’s when we blow it!!

Dealing with the core issue

It is very difficult to buy this concept. I understand that. Personally, it took me a while before I finally had the courage to face it, and to understand that, it doesn’t matter how I take it or perceive it, by my conscious mind. The subconscious plays the lead here. And no matter how much I refused to accept that, it wasn’t that way. Any amount of self-talk and affirmations were not helping here and the subconscious mind just snickered back at me by decreasing my account. This was of course a very basic example but am sure you get the drift. There are various ways of overcoming this obstacle – NLP (Neuro-linguistics programming), Hypnosis and many more. I do not want to dwell in to those vast topics in this blogpost but I hope I have enabled the readers to think in that direction.

Bottom line, discounting psychology is the same as discounting your mental health. Psychology doesn’t mean seeing a shrink. It means being aware of your mind and its behaviors. Surely, we are not going to try and make an argument that mental health is unimportant. Skill is composed of more things than just physical prowess. There is also mental aptitude. And in order to exercise our mind, we must at least accept that psychology (and the subconscious mind) is not a “prank”.

Happy trading all !!