Introduction

When it comes to trading the markets, we are always inundated with so much of information (I call it as ‘Information constipation’) that we could no longer see the forest but obsessed with just seeing the trees. The process of trading or speculation (as they call it), has morphed into a pseudo-intellectual science and consequentially, traders think that they must strain their brains to profit. Trading, however, is anything but an intellectual exertion. In fact, the more we use our brain in trading, the more likely we are to find ourselves with negative P&L. » More »

Introduction

Journaling our trades or in rudimentary terms, record-keeping is simply recording the trades with different set of values but it is not as simple as that. Now, I can hear some voices – ‘What is the big deal about journaling my trades? I have the best method in the world which is raking in 10% profits per week and so, I don’t need them” Fair enough. Happy for you!! » More »

Someone asked me a question on ‘how to be disciplined all the time?’ and there was no easy answer. He was disciplined in following his plan most of the times but could not do it 100%. Tried my best to address this typical mindset. » More »

Audio/Video response to the tweet posted on April 26th 2018

https://twitter.com/madan_kumar/status/989432327846576128 » More »

A trader asked me a question about how to develop the discipline in following his trading plan. Am sure many of us can relate to the questioner’s mindset in ‘trying to recover the losses as quickly as possible’. It is clearly evident that the trader does not believe in bouncing back slowly. He is also well aware of the risks involved in trading stock futures on result days but he could not control the urge to put on a trade. » More »

Few people have emailed me about ‘being impatient’ in executing their trades (both entry and exit) and I have already written a blogpost on patience few weeks ago. Here it is.. » More »

This is in continuation with the previous post on psychology and subconscious mind. There were some interesting messages in twitter after I posted the first blogpost on psychology. Here is the link to the previous post. » More »

How many times have we heard this word ‘psychology’ getting associated with trading profession? Innumerable times. To the uninitiated, it seems to be an over-rated (probably abused) word. I will make an attempt to give a different perspective about psychology’s part in trading as there are lot of literature that talks about cliched topics like ‘handling fear/greed and discipline issues’. We will not focus on those items in this blogpost. » More »

There was a small surge of direct messages in twitter this weekend on why I should not bother about people trolling about the recent drawdown in my daytrading activity. I casually mentioned in one of the tweets that “My ego and self-image are not attached to trading success” and it made me thinking on why people give priority to ego over making money in trading. Hence this post. » More »

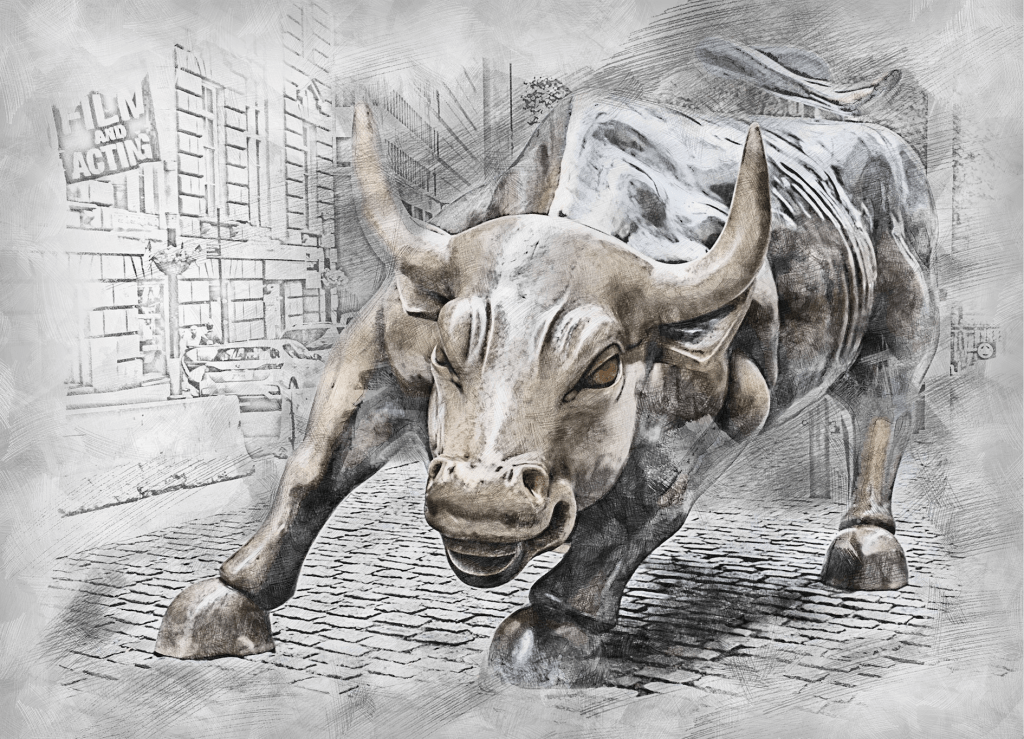

When I first started full-time trading, I was always looking to find/figure out a system with best win-rate and highest return possible. As years passed by, I came to terms with other tenets of trading that ‘actually’ makes the difference in shifting from unprofitable to a consistently profitable trader. This post is about those tenets and it might sound trivial to seasoned traders but it is always good to revisit basics every now and then. We tend to ignore the basics as we move on (this applies to all kinds of profession/business). » More »