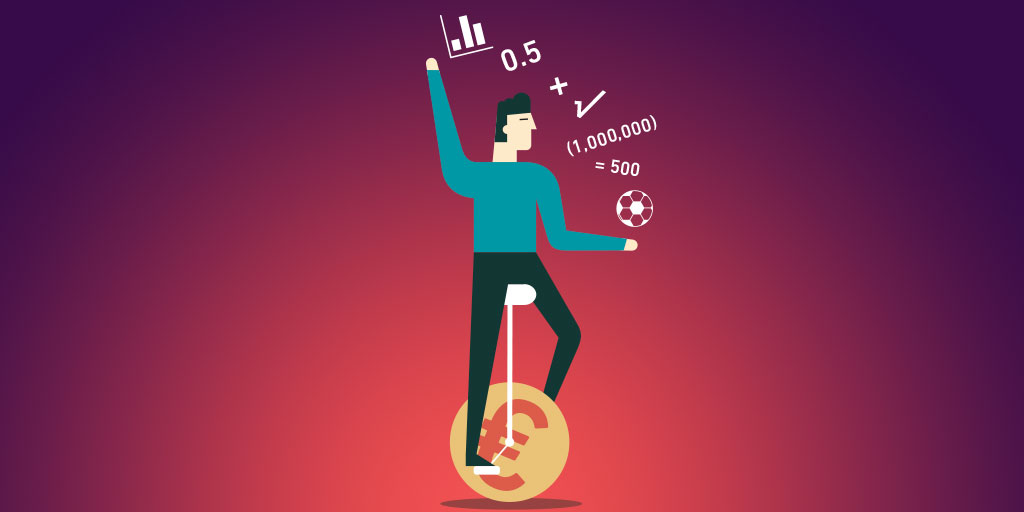

Besides loving to trade and playing cricket, I am an ardent subscriber to the statistical concept – the law of large numbers. According to probability theory, the law of large numbers is a theorem that describes the result of performing the same experiment a large number of times. Moreover, the average of the results obtained from a large number of trials should be close to the expected value, and will tend to become closer as more trials are performed. » More »