Most of you already know that am not a religious person but the mythological books can teach us many life lessons. So, my reading habit obviously gravitates even towards mythological stories/ books. » More »

Most of you already know that am not a religious person but the mythological books can teach us many life lessons. So, my reading habit obviously gravitates even towards mythological stories/ books. » More »

We have often heard successful people mentioning in their speeches/articles that one should ‘Get out of their comfort zone’ to taste success. What this phrase really means? » More »

Indian stock market starts at 9:15 am. Well past the usual breakfast time for many. Yes – this post is about food 🙂 » More »

I had put a poll on twitter yesterday with options to choose from various combinations of Winrate and Risk:Reward(RR) » More »

Besides loving to trade and playing cricket, I am an ardent subscriber to the statistical concept – the law of large numbers. According to probability theory, the law of large numbers is a theorem that describes the result of performing the same experiment a large number of times. Moreover, the average of the results obtained from a large number of trials should be close to the expected value, and will tend to become closer as more trials are performed. » More »

I have been active in Twitter for the past 6 months and this side of world seems to be filled with overly-expressive folks, especially, when it comes to trading. Traders bicker with each other like kids for everything under the roof and keep fighting that their method is the best in the markets. Even a 5-year experienced trader knows that there are many ways to skin a cat and one method is not superior to other. » More »

A trader asked me a question about how to develop the discipline in following his trading plan. Am sure many of us can relate to the questioner’s mindset in ‘trying to recover the losses as quickly as possible’. It is clearly evident that the trader does not believe in bouncing back slowly. He is also well aware of the risks involved in trading stock futures on result days but he could not control the urge to put on a trade. » More »

Few people have emailed me about ‘being impatient’ in executing their trades (both entry and exit) and I have already written a blogpost on patience few weeks ago. Here it is.. » More »

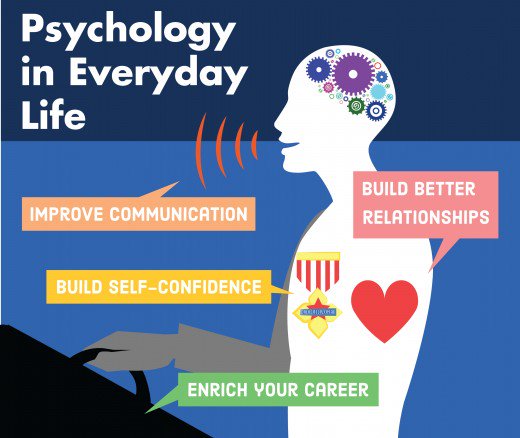

This is in continuation with the previous post on psychology and subconscious mind. There were some interesting messages in twitter after I posted the first blogpost on psychology. Here is the link to the previous post. » More »

How many times have we heard this word ‘psychology’ getting associated with trading profession? Innumerable times. To the uninitiated, it seems to be an over-rated (probably abused) word. I will make an attempt to give a different perspective about psychology’s part in trading as there are lot of literature that talks about cliched topics like ‘handling fear/greed and discipline issues’. We will not focus on those items in this blogpost. » More »